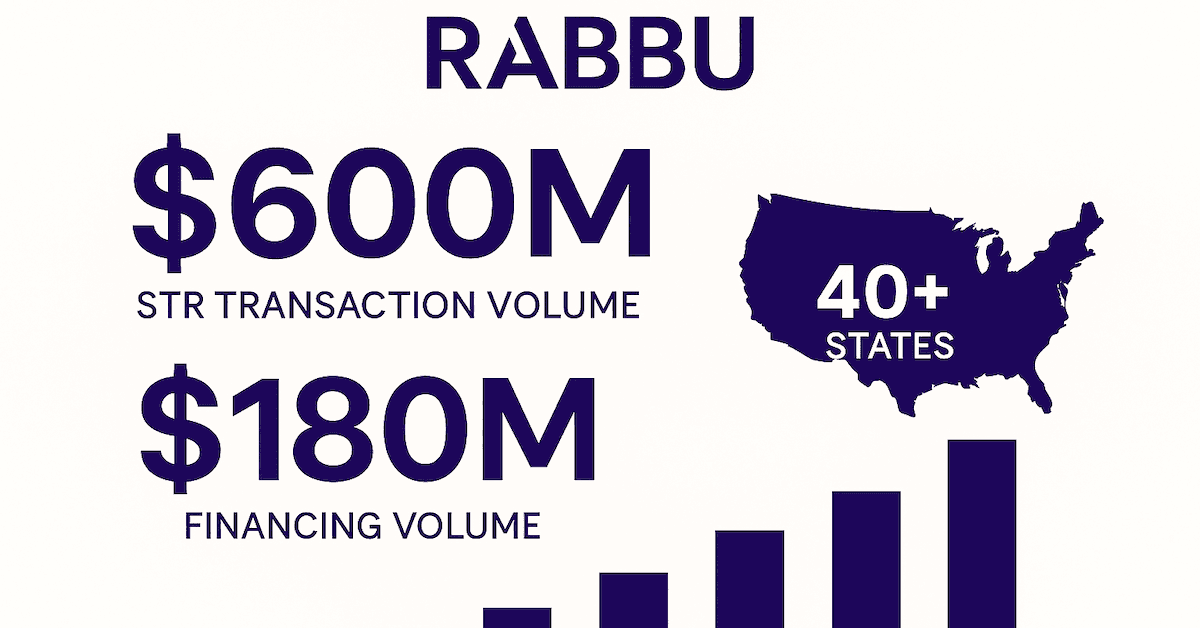

Rabbu, a marketplace for short-term rental property transactions, announced it facilitated more than $600 million in real estate deals and $180 million in loan originations in 2025. This growth reflects the rapid maturation of the Airbnb investment sector as short-term rental properties transition from individual side hustles to a recognized investment class. "We're witnessing the professionalization of an asset class," said Emir Dukic, CEO of Rabbu. "What was once a fragmented market of individual Airbnb hosts is becoming a sophisticated investment category with specialized platforms, data models, and financing products."

Investors are increasingly demanding specialized analytics and financing unavailable on traditional real estate platforms. Rabbu's platform provides access to exclusive Airbnb inventory, real-time income projections, occupancy modeling, and verified revenue histories—data points absent from residential-focused platforms like Zillow and Realtor.com. The company's 2025 growth reflects broader investor demand for turnkey Airbnb investment opportunities with established booking histories, predictable cash flow analysis based on local market data, specialized financing products designed for STR economics, and market transparency including occupancy rates and seasonal demand patterns.

The platform expanded its STR-specialized agent network to more than 40 states in 2025 and released new underwriting tools integrating property-level performance data with market analytics. Economic uncertainty throughout the year pushed investors toward income-generating assets with verifiable performance metrics. Unlike traditional rental properties with fixed lease terms, short-term rentals offer dynamic pricing flexibility and increased revenue potential, but require sophisticated analysis. "Investors are moving beyond gut instinct," Dukic noted. "They want lender-ready reports, historical comps, and confidence in their underwriting before committing capital."

The company's growth indicates how platforms like Rabbu are addressing the specific needs of this evolving market segment. More information about the company's services is available at https://rabbu.com. The $600 million transaction volume represents a significant milestone for the short-term rental investment sector, which has traditionally lacked the institutional infrastructure of traditional real estate markets. This development suggests that short-term rental properties are gaining recognition as legitimate investment vehicles with their own unique characteristics and requirements.

The specialized financing products mentioned by Rabbu's CEO represent a crucial development for investors who previously struggled to secure appropriate financing for short-term rental properties through traditional lending channels. The integration of property-level performance data with broader market analytics in underwriting tools addresses a significant gap in the investment process, allowing for more accurate risk assessment and valuation. This data-driven approach contrasts sharply with the more speculative methods that characterized early short-term rental investing.

The expansion of Rabbu's specialized agent network to over 40 states indicates growing geographic diversification of professional short-term rental investment activity beyond traditional tourist hotspots. This geographic spread suggests that investors are recognizing income potential in a wider range of markets, supported by the sophisticated data analytics now available through platforms like Rabbu. The company's reported metrics provide tangible evidence of the scale that the professional short-term rental investment market has achieved, moving it firmly into the mainstream of real estate investment categories.